Introduction

Augmented reality in accounting is changing the way firms work in the USA. It blends digital data with the real world, so numbers become easier to see and understand. Many companies now use AR technology in finance to improve accuracy, speed, and communication. The idea may sound advanced, but it’s actually simple when broken down. This guide explains the benefits, real examples, and the future of AR without any complex jargon.

Understanding Augmented Reality in Accounting

What AR Means for Today’s Accounting Work

Augmented reality adds digital layers on top of physical objects. It helps accountants see data more interactively. Many firms rely on digital transformation in accounting, but AR takes this transformation much further. It allows users to explore and interact with financial information like never before.

You don’t need expensive equipment to start. Most modern iPads and Android tablets already support AR applications. Therefore, many firms begin experimenting without major hardware investments.

Why AR Technology Fits Modern Accounting

AR helps users understand information faster. It also reduces mistakes by showing real-time data in 3D financial data visualization formats. As a result, accountants avoid confusion and work with more confidence. Firms that adopt immersive financial visualization often notice smoother workflows.

The main advantage is comprehension speed. Studies show people process visual information 60,000 times faster than text. Consequently, AR helps accountants and clients understand complex finances much quickly.

Augmented Reality: A New Dimension in Accounting

How AR Expands Traditional Tools

AR doesn’t replace normal accounting tools. Instead, it enhances virtual accounting tools by creating richer interaction. Users can point a device at a desk and instantly see financial dashboards floating above it. This experience helps reduce the mental pressure of analyzing long spreadsheets.

Linking AR With Accounting Software Innovation

Most AR platforms now work with cloud-based accounting systems. This connection helps users update information instantly. Because of this integration, AR-enabled workflow tools keep teams aligned and reduce delays.

Enhancing Data Visualization

3D Views That Make Numbers Easier to Understand

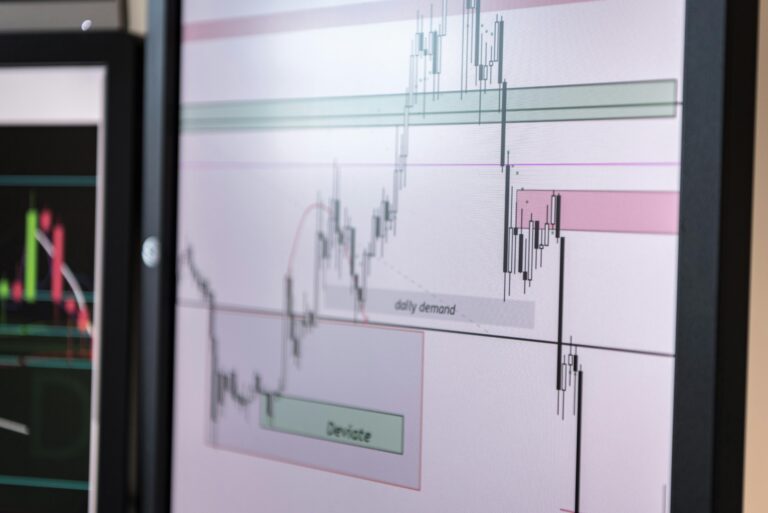

Many accountants struggle with complex financial reports. However, augmented reality bookkeeping turns these reports into simple visuals. A chart can appear as a floating 3D model that users can rotate to explore deeper insights. This makes learning faster and more enjoyable.

Interactive Dashboards for Faster Decisions

AR dashboards for accountants allow them to tap or look at sections to reveal more details. These dashboards support real-time data interaction in accounting, which improves efficiency. Instead of scanning hundreds of rows, users focus on what matters most.

Revolutionizing Financial Data Presentation

Better Presentations for Clients and Teams

AR helps accountants present data more engagingly. For example, a firm can show a 3D profit model during client meetings. This approach makes clients feel more involved. It also helps reduce misunderstandings because the visuals speak for themselves.

Simplifying Complex Reports

Financial reports often overwhelm non-financial teams. However, accounting data visualization tools powered by AR break information into clear layers. Each layer explains the story behind the numbers. Therefore, strategic planning becomes easier for everyone.

Streamlining Auditing Processes

AR-Based Auditing Solutions

Auditors often deal with missing documents and confusing data flows. AR-based auditing solutions help them track issues on the spot. They can scan items and see connected documents instantly. This reduces the time spent searching for files.

Improving Accuracy During Audits

AR makes it easy to verify records. When an auditor views an item, AR can show related data from an ERP integration. This creates fewer errors and improves confidence. It also supports automation and AR in accounting, which results in faster audits.

Revolutionizing Audit Efficiency

Faster Checks With Real-Time Insights

Audit teams move quickly when information updates in real time. AR-assisted financial reporting tools display corrections immediately. As a result, teams don’t repeat tasks. This reduces stress and shortens audit cycles.

Reducing Manual Work

Many audit steps involve repetitive work. AR technology can track and highlight discrepancies automatically. It allows users to focus on judgment and analysis rather than manual data entry.

Improving Decision-Making

Better Insights With Predictive Visualization

AR transforms decision-making tools by showing predictive financial modeling in 3D. When patterns appear visually, they become easier to understand. This clarity helps leaders make smart choices with confidence.

Faster Collaboration Across Teams

Teams often work remotely. However, AR applications in business finance allow everyone to view the same digital model at once. This shared view removes confusion and makes conversations smoother.

Augmented Reality’s Role in Strategic Financial Decisions

Helping Leaders Look Ahead

AR supports long-term planning by making trends easier to explore. Leaders can view cost forecasts, risk maps, and performance charts in an immersive format. As a result, decisions become more reliable.

More Confidence in Data

AR highlights important sections automatically. This helps managers focus on key issues without scanning pages of text. Therefore, they save time and improve accuracy.

Training and Skill Development

AR Training Tools for New Accountants

AR training for accountants creates simulations that feel real. New learners can practice tasks without pressure. This method improves learning speed and builds strong skills.

Improving Learning Through Visualization

Training becomes more fun when learners interact with AR-enabled visuals. For example, AR can show how an invoice flows through an accounting system. This builds confidence in complex tasks.

Building Skills for the Future

Preparing the Workforce for Digital Finance

The future of the accounting profession will rely on smart accounting systems and digital finance ecosystems. AR helps workers adapt quickly. They learn modern tools without feeling overwhelmed.

Better Understanding of Workflows

AR helps accountants see how different tasks connect. When they understand these links, they produce better results. This boost improves performance in the long run.

Challenges and Future Prospects

What Makes AR Hard to Adopt

Some firms struggle with cost management with AR. Others worry about training time or device requirements. However, these issues fade with proper planning and support.

How Firms Can Start Small

Companies don’t need to launch a full AR system at once. They can begin with simple AR dashboards. Gradual steps make adoption easier and less stressful.

Overcoming Challenges in Reality Accounting

Balancing Cost and Benefits

Every new tool brings challenges. However, AR-driven decision analytics deliver strong long-term value. Many firms find the benefits outweigh the setup costs.

Ensuring Smooth Team Adoption

Teams may feel unsure about new tech. Clear guidance, small training sessions, and hands-on demos help reduce these concerns.

Ensuring Compliance and Security

Protecting Financial Data

AR platforms must follow strict security rules. Firms should use encrypted systems to keep sensitive data safe. This builds trust within the organization.

Compliance With Financial Regulations

Accounting teams must follow USA regulations. AR tools often include built-in compliance checks. These checks reduce risks and prevent errors.

Adapting to Rapid Technological Changes

Staying Updated With New Features

Technology evolves quickly. Firms should update their AR platforms often. This ensures tools stay reliable and efficient.

Training as Tech Advances

Regular training helps teams stay sharp. As technology changes, learning must continue to keep everyone confident.

Future Prospects for Augmented Reality in Finance

More Automation Ahead

AR will combine with AI and other tools to automate complex accounting tasks. This creates smarter, faster financial workflows.

New Opportunities for Firms

As AR grows, firms can offer new services. These include immersive client presentations, smarter audits, and advanced financial analysis.

AR Transforms the Numbers Game

Making Complex Data Fun to Explore

AR turns boring spreadsheets into exciting visuals. This helps people enjoy learning and understanding their numbers.

Improving Communication

Teams communicate better when they see the same AR model. This reduces confusion and speeds up decisions.

AR Applications in Daily Accounting Work

Simple Tools for Daily Tasks

AR helps with tasks like invoice matching, account reviews, and cost tracking. These improvements reduce stress and save time.

Better Navigation Through Systems

AR highlights buttons, links, and fields inside accounting software. Users don’t feel lost anymore.

Strategic Benefits for Accounting Firms

Higher Accuracy Across Workflows

AR reduces mistakes by guiding users visually. This builds trust and ensures smooth operations.

Improved Client Trust

Clients appreciate clear visuals. AR presentations make firms look modern, confident, and professional.

Implementation Considerations

Planning the Rollout

Firms should choose features based on their needs. A slow rollout helps avoid confusion and ensures smooth learning.

Budgeting and Tech Needs

Equipment costs seem high at first. However, most AR tools work on smartphones, which makes implementation easier.

The Future of AR in Accounting

Growing Use Across the Industry

AR adoption will rise as technology becomes cheaper and more accessible. Firms that start early gain a major advantage.

Preparing for Tomorrow’s Tools

New AR features will blend with AI, blockchain, and cloud systems. This combination will shape the next era of finance.

FAQ’s

How is augmented reality changing accounting practices?

It makes data easier to understand, improves accuracy, and speeds up daily tasks. VR might work for immersive training scenarios, but AR fits daily workflows better.

What are some real examples of AR in accounting firms?

Firms use AR for auditing, training, client presentations, and 3D financial modeling. Modern iPads and high-end Android devices support AR without additional hardware.

Does AR help improve reporting accuracy?

Yes. It shows real-time data and highlights errors instantly. This includes setup, integration with existing systems, and initial training. Full firm-wide rollout usually takes 3–6 months, depending on your size.

What devices do firms need for AR?

Most AR tools run on smartphones, tablets, or AR headsets. Integration quality varies, so confirm your specific software version is supported before purchasing.

Is AR the same as virtual reality in accounting?

No. AR adds data to the real world, while VR creates a fully digital environment. Your data stays in existing secure systems while AR simply visualizes it differently. However, vet vendors carefully and require proof of compliance certifications.

Conclusion

Augmented reality in accounting is reshaping the financial world with faster workflows, clearer visuals, and smarter decisions. As more firms adopt AR tools, the industry will continue to evolve and open new opportunities for professionals in the USA.

The technology isn’t replacing accountants—it’s amplifying their capabilities and value. Your clients deserve insights they can understand, and your team deserves tools that eliminate tedious work. Therefore, exploring AR opportunities now positions your practice for competitive success as the technology becomes standard across the profession.

2 Comments